By SWNS Staff

NEWS COPY w/ VIDEO + INFOGRAPHIC

It’s official – the best surprise in life is randomly finding money, according to new research.

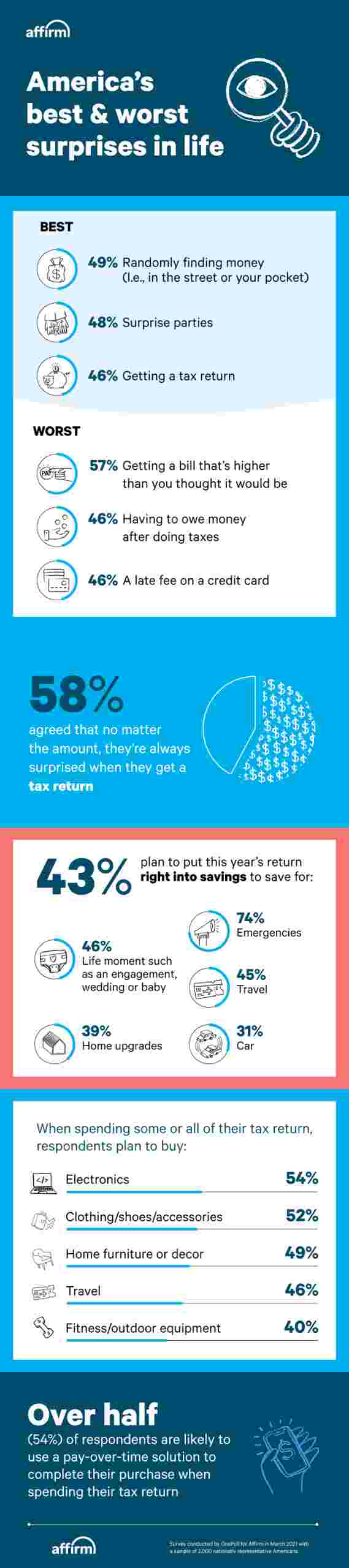

The study polled 2,000 nationally representative Americans and found nearly half (49%) identified finding money on the street or in a forgotten coat pocket is the best surprise you can get.

According to 46% of respondents, getting a tax refund was their next favorite surprise, and 58% agreed that no matter the amount, they’re always surprised. Aside from financial surprises, respondents also cited surprise parties, engagements, pregnancies and puppies as their other favorite types of surprises.

And while there are good surprises, there are also plenty of bad ones. The study, conducted by OnePoll on behalf of Affirm, found that paying a bill that’s higher than you expected topped the list of worst surprises.

Next in line for worst surprises ever included having to OWE money after doing your taxes and getting dinged with a late fee on a credit card.

In fact, 64% of respondents agreed there’s nothing worse than getting hit with a late fee – and three in five said that can completely ruin their day.

[youtube https://www.youtube.com/watch?v=dRPk9av6pFw?enablejsapi=1&autoplay=0&cc_load_policy=0&iv_load_policy=1&loop=0&modestbranding=0&rel=1&showinfo=1&theme=dark&color=red&autohide=2&controls=2&playsinline=0&&w=640&h=360]

The study also delved into how respondents plan to handle their tax refunds this year and found 43% plan to put their refund directly into their savings.

When asked what they’re saving for, respondents stated the top reason is for emergencies (74%), followed by life moments like getting married or having a baby (46%), travel (45%) and home upgrades (39%).

“It is no surprise that tax season can spark conflicting emotions – 58% of respondents are always surprised when they get a refund, regardless of the amount, but the top emotion respondents feel when they owe money after doing their taxes is annoyance,” said Silvija Martincevic, Chief Commercial Officer at Affirm.

Respondents were then tied for their number two option on how to use their refund – with 40% opting to make a credit card payment, invest it or give to charity.

Nearly a quarter (24%) of those surveyed said they’d make a student loan payment and 18% said they would spend it on something nice for themselves.

For those looking to spend, the top categories were electronics (54%), clothing, shoes and accessories (52%), car repairs (48%), home furniture or decor (49%), travel (46%), and fitness and outdoor equipment (40%).

When it comes to making their purchases, over half (54%) of respondents stated they are likely to use a pay-over-time solution with the top reason being pay-over-time solutions enable them to stay on budget (49%).

“Whether you plan to save or spend your tax refund this year, Affirm is here to help. For those looking to save, our high-yield savings account requires no minimum deposit and never charges fees. And if you want to spend, paying over time with Affirm can help you do so responsibly, without hidden fees, to ensure you’re getting the most out of your refund.”

TOP 10 BEST SURPRISES

- Randomly finding money (I.e., in the street or your pocket) – 49%

- Surprise parties – 48%

- Getting a tax return – 46%

- Surprise visitors like family or friends – 37%

- Engagements – 35%

- Pregnancies – 33%

- A puppy/pet – 30%

- A snow day – 28%

- Canceled plans – 20%

- Pushed deadline – 13%

TOP 10 WORST SURPRISES

- Getting a bill that’s higher than you thought it would be – 57%

- Having to OWE money after you do your taxes – 46%

- Late fee on a credit card – 37%

- Child breaks something – 31%

- Pet has an accident in the house – 31%

- Unexpected visitors (I.e., the in-laws) – 29%

- Canceled plans – 27%

- Going on a date with someone and they don’t match their profile photo – 20%

- Last-minute video meeting – 20%

TOP THINGS RESPONDENTS PLAN TO DO WITH THEIR TAX REFUNDS

- Put it in savings – 43%

- Make a credit card payment – 40%

- Invest it – 40%

- Donate to charity – 40%

- Make a student loan payment – 24%

- Spend it on something nice for myself – 18%

Payment options through Affirm are provided by these lending partners: affirm.com/lenders. Affirm savings accounts are held with Cross River Bank, Member FDIC.