By SWNS Staff

NEWS COPY w/ VIDEO & INFOGRAPHIC

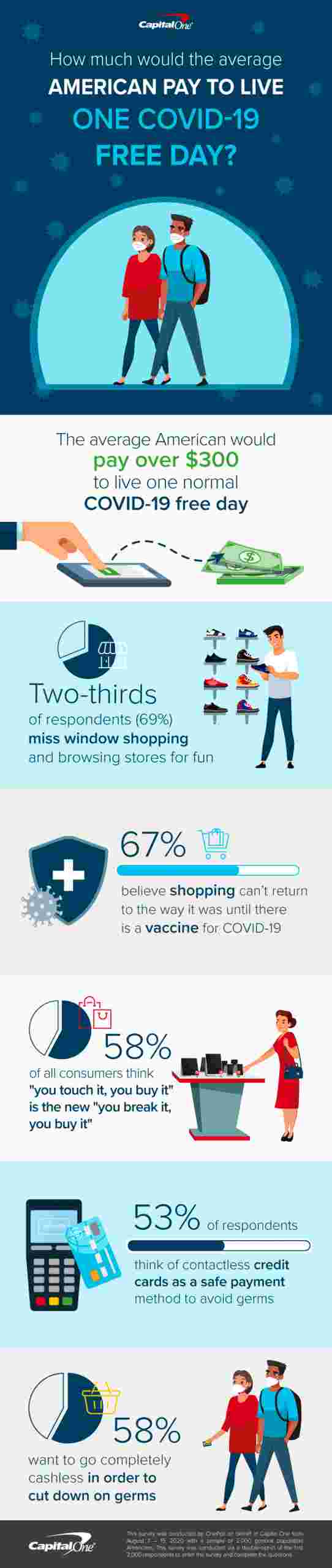

The average American would pay over $300 to live one normal COVID-19 free day, according to new research.

One in four surveyed would spend $500 or more just to live a pre-pandemic day again.

It’s no wonder Americans would spend so much cash for a worry-free day since there’s a ton of activities they’re missing now, revealed in a new survey conducted by OnePoll and commissioned by Capital One.

The top activities missed by respondents were dining out at a restaurant (54%), hanging out with friends (44%), going to a movie (41%) and enjoying a “day out” (41%).

The study of 2,000 Americans examined how much they’re craving their pre-pandemic lives.

The average of those surveyed miss five people they were on friendly terms with who they used to see throughout their week like grocery store workers (39%), coffee shop baristas (33%) and waiters and waitresses (28%).

Beyond their chatting with old pals, two-thirds of respondents (69%) also miss window shopping and browsing stores for fun.

Four in five don’t browse in stores at all since the start of COVID-19 and complete their trip as quickly as possible.

Two-thirds (67%) of respondents believe shopping can’t return to the way it was until there is a vaccine for COVID-19.

Even the way people shop has taken a dramatic shift. Sixty-eight percent think the days of touching, trying and testing products in-store is over as they’re driven to buy more online.

When it came to shopping habits that would cause respondents to hesitate nowadays, trying on an item in a changing room topped the list with 45%.

Two in five (42%) wouldn’t try food samples anymore and over a third (36%) wouldn’t touch produce for freshness before purchasing.

As respondents approach the cashier, they’ve continued to adapt to the pandemic. More than half (58%) of all consumers think ‘if you touch it, you buy it’ is the new ‘you break it, you buy it.’

Three in five (63%) are more likely to use their credit card more often than cash when it comes to their weekly spending since the rise of COVID-19.

Fifty-three percent of respondents think contactless credit cards as a safe payment method to avoid germs, followed by using a mobile wallet feature (42%) and swiping their credit card (42%).

While contactless credit/debit cards came out as the number one payment method respondents thought was safe against germs, some are still confused by it.

A quarter (25%) have found the machines confusing and know where on different machines to tap their card.

Twenty-five percent also revealed their concerns about the security of contactless credit cards.

“Despite perceptions, transactions in contactless credit cards are just as secure as chip credit cards since they use the same technology. Contactless credit cards feature innovative payment technology to help protect cardholders from fraud so they can feel confident their information is safe,” said Ian Forrester, Senior Vice President, US Card at Capital One. “Also with contactless cards, you can check out in seconds by tapping or hovering your card on the credit card reader. Contactless cards, like the Platinum Mastercard from Capital One, are accepted at thousands of stores, including grocery stores, gas stations and restaurants.”

Fifty-eight percent want to go completely cashless in order to cut down on germs, even though it’s caused a struggle (49%).

Three in five (61%) estimated they’ve spent more online shopping during the pandemic than they would have in pre-COVID-19 time.

It’s no surprise then that three-quarters of respondents want more tools to help them find the best deals for online shopping so they’re spending smarter. Fifty-eight percent (58%) said they’d be willing to explore digital payment alternatives if they understood them better.

“The survey data indicates that respondents have undergone dramatic changes in their shopping habits during the pandemic. In fact, nearly half of the survey respondents (48%) are more likely to let the cashier ‘keep the change’ due to COVID-19,” said Forrester. “With this in mind, Capital One is meeting customers where they are by investing and building innovative products that look out for customers and their money while speeding up checkout with simple and safe ways to pay,” said Forrester.

How much would you be willing to pay (in dollars) to live one ‘normal day’, pre-COVID’?

- $0 24.25% (485)

- $1-100 20.70% (414)

- $101-300 14.05% (281)

- $301-500 14.60% (292)

- $501-700 11.25% (225)

- $701-900 4.75% (95)

- $901-1000 3.00% (60)

- $1001+ 7.40% (148)

- Average $305.27

TOP MISSED PRE-COVID-19 ACTIVITIES

- Dining in restaurants 54%

- Browsing through a store 49%

- Spending time with friends 48%

- Shopping for fun at the mall 42%

- Going to the movies 41%

- Having a “day out” 41%

- Taking destination vacations 40%

- Spending time with family 37%

- Going to concerts 34%

- Going to bars 26%

SAFEST SPENDING METHODS ACCORDING TO RESPONDENTS

- Contactless credit/debit card 53%

- Mobile wallet 43%

- Card swiping 42%

- Chip reader 41%

- Cash card 32%

- Gift card 27%

- Cash 16%

- Writing a check 15%

This survey was conducted by OnePoll on behalf of Capital One from August 7 – 19, 2020 with a sample of 2,000 general population Americans. This survey was conducted via a double-opt-in of the first 2,000 respondents to enter the survey and complete the questions.