By Victoria McNally // SWNS

NEWS COPY w/ VIDEO & INFOGRAPHIC

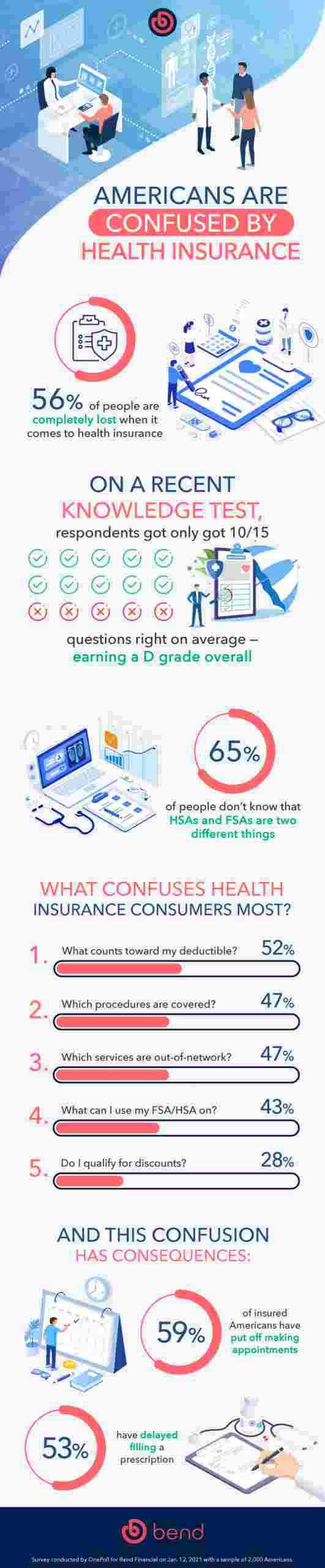

Despite being confident in their own abilities, over half of Americans are hopelessly confused by health insurance — so much so that the average American has a D-grade level of knowledge.

In a recent survey, 2,000 respondents were asked to describe their understanding of the U.S. health care system, using questions about their experiences and current base of knowledge.

An overwhelming 90% said they were “somewhat” to “completely” confident in their own ability to navigate the current system, with 29% on the “completely” confident end of the spectrum.

In contrast, only 3% said they are “not at all” confident.

Despite that, a majority of Americans admitted to feeling “completely lost when it comes to understanding health insurance” — 56%, in fact, compared to 15% who disagreed.

Conducted by OnePoll on behalf of Bend Financial, the survey also included a series of true/false and multiple-choice questions to test respondents with health care coverage on their knowledge.

Collectively, the panel of respondents only answered 10 of the 15 questions correctly — a failing D grade on a standard academic quiz.

[youtube https://www.youtube.com/watch?v=UywV2gBthk0?enablejsapi=1&autoplay=0&cc_load_policy=0&iv_load_policy=1&loop=0&modestbranding=0&rel=1&showinfo=1&theme=dark&color=red&autohide=2&controls=2&playsinline=0&&w=640&h=360]

Only 20% could identify all the correct qualified life events — meaning the special circumstances that would allow someone to enroll in a new health care plan outside of open enrollment — from a list of options.

Fifty-nine percent of people mistakenly believed that it is not allowed to have more than one health insurance plan, and another 65% marked that a health savings account (HSA) and flexible spending account (FSA) are the same thing.

According to Bend Financial Cofounder and CEO Tom Torre, this latter point is a common misconception among consumers. “At first glance, HSAs and FSAs can appear to be very similar,” he said. “But bottom line, there are many critical differences that separate the two. An HSA is a savings account, while an FSA is a spending account, and when compared side by side, HSAs offer many advantages FSAs lack.”

“With an HSA, you own your account and keep your funds even if you leave your job, switch insurance plans or retire,” Torre added. “You can choose your HSA provider, change your contributions at any time and roll over your funds year to year without penalty. You can even invest your HSA funds as an additional retirement-planning vehicle. Now more than ever, health care consumers need to be aware of these differences and how they can leverage an HSA to make their money work smarter for them.”

When asked to evaluate how they thought they did, almost half (46%) guessed they got “all or most” of the questions correct.

Younger respondents aged 18-39 were most likely to assume they did well on the quiz (52% for Millennials and 53% for Gen Z), but also performed the worst (8/15 and 9/15, respectively).

And all this confusion has real-world consequences on health care consumers. On average, respondents with current health care coverage estimated that they waste $111 per month on confusion over their health insurance plan.

Fifty-nine percent have put off making medical appointments and 53% have put off having a prescription filled out of uncertainty.

And out of all respondents regardless of health care coverage, over a third (35%) have delayed getting a necessary check-up out of concern for how much it would cost.

“Unfortunately, many people, especially those who are uninsured, don’t realize that pairing a high-deductible health plan (HDHP) with an HSA can be their key to unlocking the health insurance puzzle,” said Torre. “It can provide affordable premiums and multiple tax savings opportunities while helping chart a path toward better overall financial health.”

Of those polled, 5% said they were not covered under a health care plan, and 11% said they did not have any dental or vision coverage.

WHAT CONFUSES HEALTH CARE CONSUMERS MOST?

- What counts towards deductible (52%)

- What procedures are covered (47%)

- What’s in or out-of-network (47%)

- What can I use FSA/HSA on (43%)

- If I qualify for discounts (28%)

- Do I even have coverage (15%)

HOW ARE AMERICANS COVERED?

- Job (45%)

- Medicare (17%)

- Family member (9%)

- Medicaid (8%)

- Individual plan (7%)

- COBRA (6%)

- Not covered (5%)