By Victoria McNally // SWNS

NEWS COPY w/ VIDEO & INFOGRAPHIC

Four in 10 (40%) Americans under the age of 40 aren’t optimistic that they’ll succeed in their financial goals one day, new research suggests.

A recent study asked 2,000 people between the ages of 18-40 to describe their financial fears and goals, as well as how their experiences have been informed by previous generations.

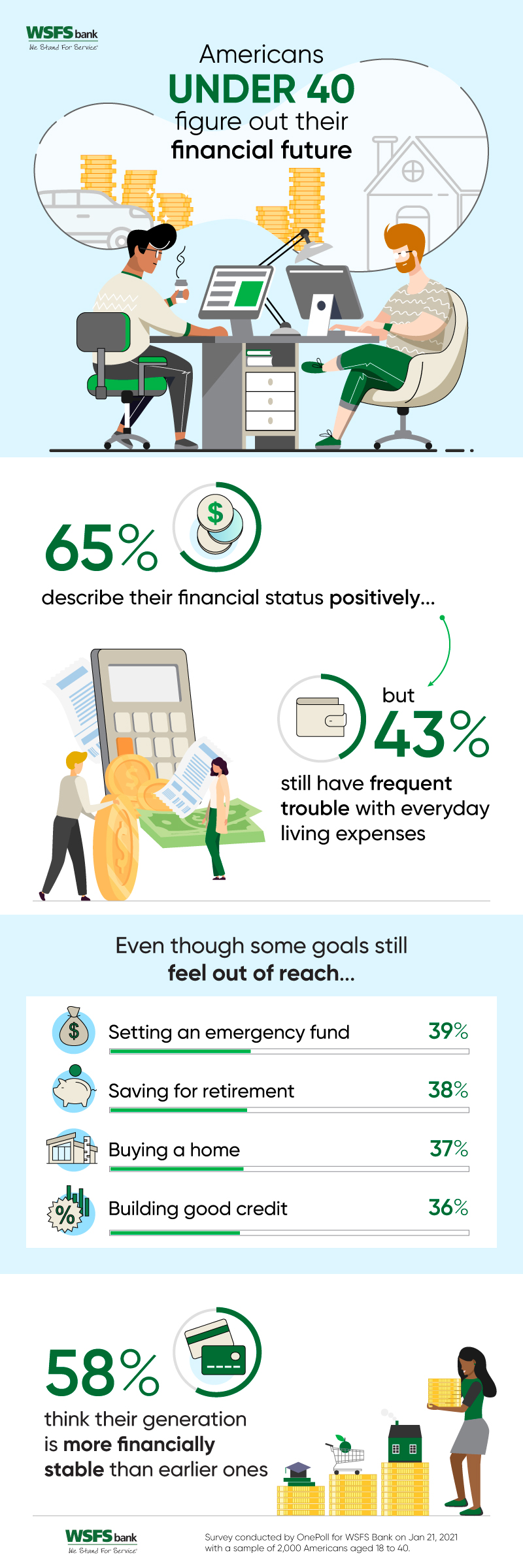

Of those polled, 43% say they frequently have trouble paying everyday living expenses, with 19% saying it happens to them “constantly.”

According to the survey, which was conducted by OnePoll on behalf of WSFS Bank, many common monetary ambitions still feel out of reach for the nation’s Gen Z and Millennial populations.

Topping the list of most “impossible-seeming” goals: Saving for emergency funds (39%), saving for retirement (38%), buying a home (37%) and building good credit (36%).

When it comes to financial setbacks, respondents were most worried about losing a job or taking a pay cut (48%), making bad financial decisions (40%), and needing to file for bankruptcy (39%).

In fact, 58% said they actively avoid thinking about or navigating their finances out of fear that “they’ll mess it up.”

[youtube https://www.youtube.com/watch?v=FnKlARmZ-0M?enablejsapi=1&autoplay=0&cc_load_policy=0&iv_load_policy=1&loop=0&modestbranding=0&rel=1&showinfo=1&theme=dark&color=red&autohide=2&controls=2&playsinline=0&&w=640&h=360]

Six in 10 (59%), for example, are still “terrified” by the idea of having to apply for mortgages.

“While overspending is often the first thing that pops into consumers’ minds when they think of financial troubles, financial stagnation has played just as large a role in recent years,” said Vernita Dorsey, SVP and Director of Community Strategy at WSFS Bank. “It’s never too late for any generation to prioritize money management to build financial stability and wealth for yourself and future generations. There is an abundance of educational content online to help build your financial confidence.”

Despite these setbacks, 65% of respondents would describe their overall financial situation as either “good” or “excellent,” and 58% think their generation’s level of financial stability is actually better than that of previous generations.

But those who are less optimistic about their generation’s financial stability brought up high costs of living, lack of job opportunities, income inequality and issues with credit or debt.

“I think student debt is more crushing for my generation,” one respondent said. “More of us went to college, whereas my parents didn’t. I also think the cost of living, including technology [prices], are so much more expensive than when my parents were my age.”

Over half (57%) also blamed the previous generation’s mistakes for the country’s current financial system.

Roughly one in three respondents, for example, believe that living through the housing crisis of 2008 had a huge impact on their financial behavior — about the same number as those who cited the current COVID-19 crisis (30%).

An even larger number of respondents cited the 2015 mini-recession (39%), the Occupy Wall Street movement (38%), and the 2017 Tax Cuts and Job Act (34%) as affecting their financial habits.

“Unfortunately, Millennials and Gen Z have lived through many recessions and market disruptors causing additional financial stress and resulting in tighter job and economic markets,” said Dorsey. “While these generations have proved to be resilient despite these crises, they’re left feeling that big financial goals, like buying a house, remain out of reach. With only 23% of respondents saying they learned financial skills in school, it is clear a financial literacy gap exists that, if addressed, could help build solid foundations prior to reaching adulthood.”

TOP 5 BEST MONEY HABITS OF AMERICANS UNDER 40

- Paying bills on time – 53%

- Reviewing bank statements – 47%

- Living within my means – 45%

- Increasing 401k deductions – 45%

- Sticking to a budget – 39%

WHERE YOUNGER AMERICANS PICK UP THEIR FINANCIAL SKILLS

- Parent(s) – 36%

- Romantic partner(s) – 33%

- Grandparent(s) – 31%

- Teacher(s) – 29%

- Older sibling(s) – 27%

- Other family member(s) – 26%

- Friend(s) – 27%

- School – 23%

- Online or print publications – 23%

- Government resources – 20%