By Danielle Moore // SWNS

NEWS COPY w/ VIDEO + INFOGRAPHIC

Over six in 10 Latino Americans believe they are experts at saving money — but less than half think they’re similarly adept with investing, according to new research.

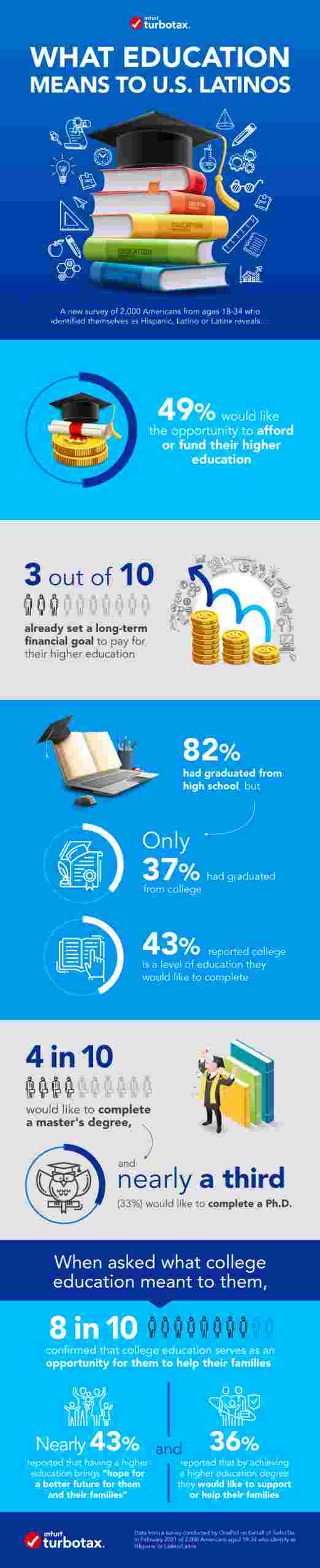

A recent study asked 2,000 Americans between the ages of 18 and 34 who identify as Hispanic or Latino/Latinx to evaluate their own financial goals across a wide range of categories, including saving, investing and education.

Funding a savings account (46%), buying a home (45%) and paying off debt (38%) were the most common long-term financial goals for which respondents had already started planning.

Three in 10, moreover, had begun planning for the financial investment of higher education.

While 82% of respondents surveyed had graduated from high school, only 37% had graduated from college.

Yet 43% reported that college is a level of education they would like to achieve.

Respondents were similarly ambitious when it came to advanced degrees, with over four in 10 (41%) desiring to complete a master’s degree, and nearly a third (33%) saying the same about a Ph. D.

When asked what college education meant to them, nearly eight in 10 respondents (79%) related the opportunity to their families – with 43% selecting “hope for a better future for me and my family,” and 36% selecting the ability to “help support my family.”

[youtube https://www.youtube.com/watch?v=9s1rRaP5KTc?enablejsapi=1&autoplay=0&cc_load_policy=0&iv_load_policy=1&loop=0&modestbranding=0&rel=1&showinfo=1&theme=dark&color=red&autohide=2&controls=2&playsinline=0&&w=640&h=360]

The study, which was conducted by OnePoll and commissioned by TurboTax in celebration of their #LeadingConEducación program, also examined respondents’ confidence in their financial decision-making.

Financial literacy can be half the battle when it comes to making money decisions that can impact your future, and respondents proved resourceful in the mix of sources from which they tended to seek information on the best money management options for their needs.

Finance websites (32%) and financial advisors (33%) were top sources of info among this demographic.

And over a quarter of respondents (26%) were most likely to seek info on the best financial management options for them via finance apps.

When asked which monetary resources they would like more of, or the opportunity to fund, over four in 10 (43%) identified higher education.

Yet other common financial goals were more intangible, with over seven in 10 respondents averring that achieving “financial freedom” is “very” or “extremely” important to them.

When asked to describe what the concept of “financial freedom” meant to them, respondents’ answers included themes of independence and future security.

“The ability to support yourself financially and not worry unnecessarily about money,” wrote one respondent.

For another, a different goal emerged: the opportunity to “…be able to help family and friends when they need or as often I can.”

“We have the opportunity to help underrepresented communities prosper through educational programs that will allow them to achieve a higher education,” said Alejandra Molinari, Lead of TurboTax Latino Communications.

“That’s why we are proud to support hard working Latino students through our #LeadingConEducación scholarship program to position themselves for success when it comes to managing personal finances starting with their own taxes.”