New Equifax research suggests individuals need to go back to basics with their knowledge of credit reports and scores

- Over half of men (53%) think that their credit score will be affected if they live with someone who has problems with debt

- 29% of men believe a ‘credit blacklist’ is used by lenders

- 16.5% of men think that money in the bank will mean a better credit score

Latest research* from Equifax, the credit information provider, reveals common consumer misconceptions about credit information and the factors that might impact their credit score. Over half of respondents to the survey amongst consumers who have accessed their Equifax Credit Report said they believe their credit score will be affected if they live with someone who has problems with debt. Nearly a third (30%) of consumers believe there is a credit blacklist used by lenders.

According to the Equifax research it seems that women are slightly more in the know about credit information. Men are more likely to think that living with someone with bad debts will affect their own credit score (53%), compared to 50% of women. And 36% of men think previous occupants at their address can impact on their credit score, compared to a third of women (33%).

In truth, previous occupants with debt problems will not affect later residents. Housemates, as well as partners and family members will only have a financial association if they have applied for a joint credit agreement, such as a mortgage or credit card. However, a lender may look at the associate’s credit information when they assess the individual’s application, so it could impact their ability to obtain credit.

There is also a belief amongst a proportion of consumers that having money in the bank will result in a better credit score. 16.5% of men believe this to be the case; 14% of women. The reality is only an overdraft – which is a credit agreement – affects an individual’s credit score.

“It’s encouraging to see that only 14% of consumers don’t think paying for everything in cash will help build a person’s credit score” said Lisa Hardstaff, credit information expert at Equifax. “Lenders typically use an individual’s credit information and payment history to assess a consumer’s ability to afford new credit and pay it back on time. Therefore, taking out some form of credit will help to build a credit history. But it’s important to remember to stay up to date on payments.

“We are also encouraged to see that consumers appear to have a good understanding of the information included on their credit report. For example, over 80% of respondents to our survey recognised that electoral roll data, personal loans, and credit and store card information is listed on a credit report.

“There is however, still a question mark over some of the details. 4% of respondents believe that speeding or parking ticket information will be included and 6% believe that their salary will be visible. None of this information is included on a credit report.

“We suggest that anyone considering applying for credit should check their credit report before submitting their application. This will enable them to ensure that they understand the types of information that will be used to assess their suitability for new credit, as well as check for any changes that might need to be made, such as updating their electoral registration.”

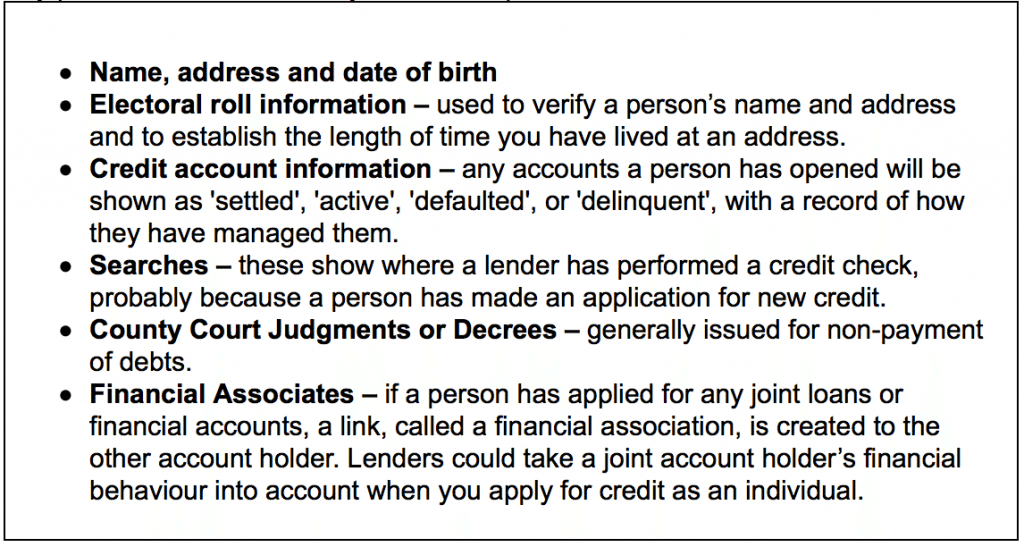

What’s on your Credit Report?

Key pieces of information on your credit report will include:

The Equifax Credit Report is accessible for 30 days free simply by logging onto Equifax Credit Report. If customers do not cancel before the end of the 30 Day Free Trial, the service will continue at £9.95 per month, giving them unlimited online access to their credit information and weekly alerts on any changes to their credit file. It also includes an online dispute facility to help them correct any errors on their credit file simply and quickly.

*Survey of 1,332 consumers for Equifax November 2016

About Equifax

Equifax, Inc. (“Equifax”) powers the financial future of individuals and organizations around the world. Using the combined strength of unique trusted data, technology and innovative analytics, Equifax has grown from a consumer credit company into a leading provider of insights and knowledge that helps its customers make informed decisions. The company organizes, assimilates and analyzes data on more than 820 million consumers and more than 91 million businesses worldwide, and its databases include employee data contributed from more than 5,000 employers.

Headquartered in Atlanta, Ga., Equifax operates or has investments in 24 countries in North America, Central and South America, Europe and the Asia Pacific region. It is a member of Standard & Poor’s (S&P) 500® Index, and its common stock is traded on the New York Stock Exchange (NYSE) under the symbol EFX. Equifax employs approximately 9,400 employees worldwide.

Some noteworthy achievements for the company include: Ranked 13 on the American Banker FinTech Forward list (2015); named a Top Technology Provider on the FinTech 100 list (2004-2015); named an InformationWeek Elite 100 Winner (2014-2015); named a Top Workplace by Atlanta Journal Constitution (2013-2015); named one of Fortune’s World’s Most Admired Companies (2011-2015); named one of Forbes’ World’s 100 Most Innovative Companies (2015). For more information, visit Equifax

Equifax Limited is one of the Equifax group companies based in the UK.

Equifax Limited is authorised and regulated by the Financial Conduct Authority.