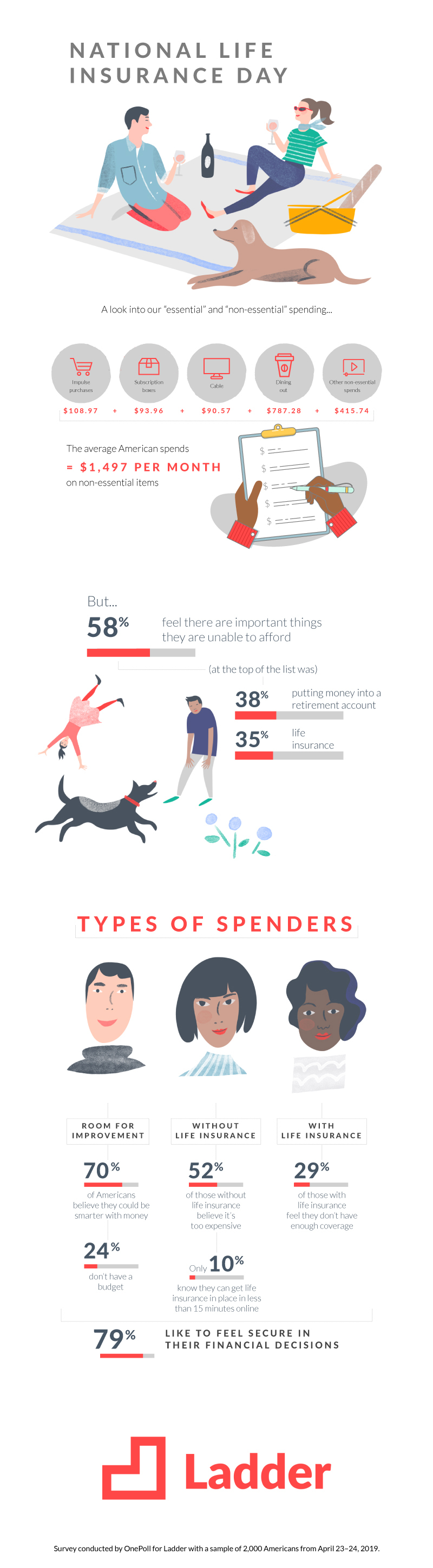

Between eating out, paying for cable and streaming services, receiving subscription boxes and other superfluous spending, the average American spends $1,497 per month on non-essential items, according to new research.

That can add up to almost $18,000 a year – or more than a million dollars over the course of an adult lifetime.

It can be good to treat yourself to something that brings you happiness, but a survey of 2,000 Americans found the average respondent does a bit more than that.

Per month, results revealed that the average American spends $20 on coffee drinks, as well as $209 on dinners at restaurants and $189 going out drinking with friends.

Many haven’t cut the cord, and are paying an average of $91 per month for cable, in addition to $23 for streaming movies and TV shows. Spending on music streaming services averaged $22 a month, while other apps added $23.

While going to the gym is good for your health, the average American spends $73 on a membership and exercise classes.

The survey revealed that Americans make an average of five impulse purchases a month – for a total of $109 – but the majority (58 percent) also feel there are other important things they can’t afford.

Commissioned by Ladder and conducted by OnePoll in advance of National Life Insurance Day (May 2), the survey looked at Americans’ spending on “essential” versus “non-essential” items, and found that Americans may be able to afford essentials more easily than they think, just by tweaking their spending habits.

In addition to looking at their spends, the survey also examined how respondents feel about their financial decisions.

Seventy percent believe they could make smarter decisions with their money on a monthly basis, and 24 percent admit they don’t have a budget.

Fifty-eight percent believe there are important things they are unable to afford – putting money into a retirement account (38 percent) and life insurance (35 percent) were at the top of the list.For those who don’t have life insurance, the top reason for not having it was they thought it was too expensive (52 percent).

“People tend to overestimate the cost of life insurance,” said Ladder Co-founder Laura Hale. “Trading off a couple of smaller short-term purchases per month can support a monthly policy payment. It can give you the longer term satisfaction that comes from making sure your family is protected.”

The survey found that only 10 percent of respondents know that they could get life insurance in place in less than 15 minutes online.

And of those who have life insurance, 29 percent feel they don’t have enough coverage.

“Term life insurance is easy to apply for now, thanks to technology,” said Hale. “You can get instant decisions on fully-underwritten policies at competitive rates. People want to do the right thing for their families. Now, it can happen in minutes.”

AMERICANS FEEL THEY CAN’T AFFORD . . .

FOR THOSE WITHOUT LIFE INSURANCE, THE REASONS WHY ARE . . .

AMERICANS’ NON-ESSENTIAL MONTHLY SPENDS