Equifax research highlights the credit hangover that pressure on parents to spend on festivities could cause in the New Year

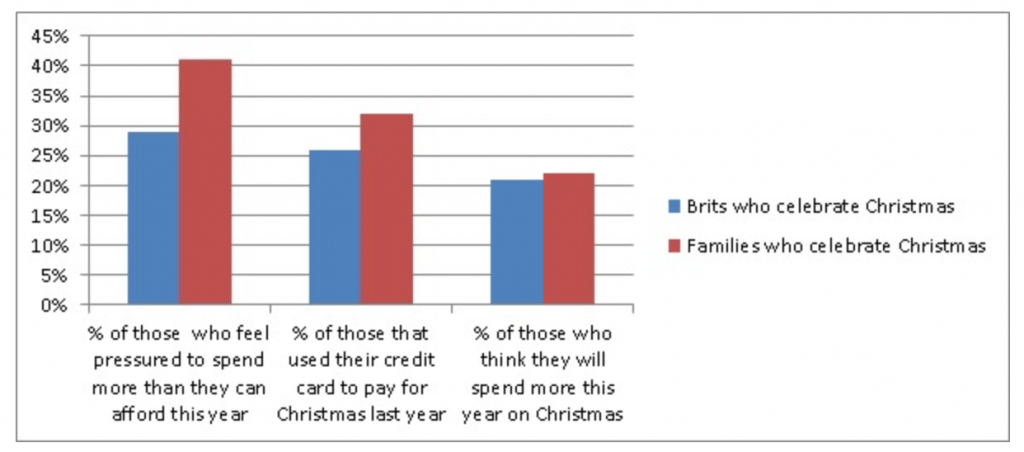

According to new YouGov research* commissioned by Equifax, the credit information expert, 29% of Brits who celebrate Christmas say they feel pressured to spend more than they can afford on gifts and goodies. This rises to a whopping 41% for those with children in their household keen to give their families a magical festive season. Equifax urges families to set a Christmas budget to help reduce the risk of starting 2017 with mounting debts.

On average, people expect to spend £441.24 on Christmas this year, but the Equifax commissioned research also reveals that families expect to spend £597.31 on the festive season and 22% of households with kids think they will spend more than they did in 2015. Highlighting the potential risk of a credit hangover in the New Year, almost a third (32%) of families used their credit card to pay for seasonal expenses last year and of these people 8% took more than six months to pay it off.

“Items such as clothing and fuel are expected to become more expensive, whilst growth in earnings slows down, so UK households could be feeling the pinch this Christmas,” explains Lisa Hardstaff, Equifax credit information expert. “However many people feel that they need to spend more than they can afford at this time of year, and 41% of families admit to bring under pressure.

“With almost a third of households using credit cards last year to pay for Christmas, we think it’s important for families to think about how they are going to manage those Christmas debts, when the bills arrive in the New Year. If they have bigger plans for 2017, they need to be mindful that late payments on Christmas debts could affect their credit score.”

*All figures, unless otherwise stated, are from YouGov Plc survey of 1,897 adults who celebrate Christmas of those 437 have 1 or more children living in their household. Field work was undertaken between 18th- 19thOctober 2016. The survey was carried out online. The figures have been weighted and are representative of all GB adults (aged 18+).

**Sky News : Essential Item Price Rises Hit Family Spending

About Equifax

Equifax, Inc. (“Equifax”) powers the financial future of individuals and organizations around the world. Using the combined strength of unique trusted data, technology and innovative analytics, Equifax has grown from a consumer credit company into a leading provider of insights and knowledge that helps its customers make informed decisions. The company organizes, assimilates and analyses data on more than 800 million consumers and more than 88 million businesses worldwide, and its databases include employee data contributed from more than 5,000 employers.

Headquartered in Atlanta, Ga., Equifax operates or has investments in 24 countries in North America, Central and South America, Europe and the Asia Pacific region. It is a member of Standard & Poor’s (S&P) 500® Index, and its common stock is traded on the New York Stock Exchange (NYSE) under the symbol EFX. Equifax employs approximately 9,200 employees worldwide.

Some noteworthy achievements for the company include: Ranked 13 on the American Banker FinTech Forward list (2015); named a Top Technology Provider on the FinTech 100 list (2004-2015); named an InformationWeek Elite 100 Winner (2014-2015); named a Top Workplace by Atlanta Journal Constitution (2013-2015); named one of Fortune’s World’s Most Admired Companies (2011-2015); named one of Forbes’ World’s 100 Most Innovative Companies (2015). For more information, visit Equifax

Equifax Limited is one of the Equifax group companies based in the UK.

Equifax Limited is authorised and regulated by the Financial Conduct Authority.