Life can often be unpredictable, but for the milestones that we can expect to face, modern mutual OneFamily has highlighted just how much they are costing the nation.

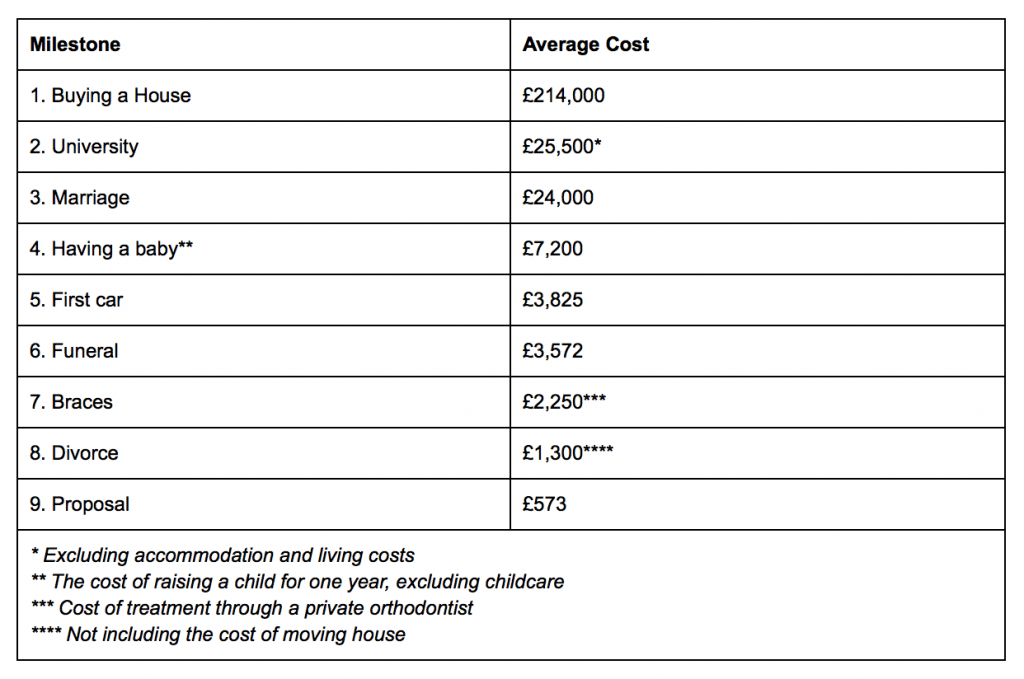

It will come as no surprise that buying a first home came out as the most expensive milestone, with the average price paid for a house by a first-time buyer currently standing at £214,000. The average deposit for a first-time buyer is 17% – giving an average deposit of £36,380.

Although many are forecasting a decrease in house prices, they are still almost 10 times higher than the second largest expense: Going to university.

Those looking to study in England can expect to spend an average of £25,500 over a three-year course on tuition fees alone.

Marriage is considered to be one of the happiest moment of a person’s life, however this can come at a price, with tying the knot typically costing around £24,000 – more than three times higher than the first year of having a child (£7,200, excluding childcare).

In the unfortunate cases where marriage ends in divorce, Brits can currently expect to spend £1,300 in legal fees per person. Where there is a house move involved, divorcees can expect to pay an additional £11,894 – covering stamp duty, estate agent and surveyors fees and removals.

Moving onto life’s final moment, the price of a funeral, including cremation, came to an average of £3,572 in 2015, a 10% increase on the previous year. For a funeral with burial, the lowest cost was found in Tyrone, Northern Ireland at £2,510 and the highest in Greater London at £8,250.

Karl Elliott, Marketing Director at OneFamily, said: “From buying your first home to watching your child take their first steps, it’s these kinds of moments that have the most lasting impact on our lives and, as our research shows, our finances too.

“With many of life’s most expensive moments typically occurring during early adulthood, it’s good to begin saving at a young age, to ensure financial security for whichever of life’s moments you face.

“A Junior ISA is an option for parents looking to start saving for their children – allowing them to make the most of life’s moments without the worry of how much it’s going to set them back financially.”

For more information on the costs of modern milestones, Lifes Moments

Notes

All sources used, unless otherwise stated, can be found on OneFamily’s Life’s Moments Infographic, which can be found here: One Family : Lifes Moments

OneFamily has created a funeral cost calculator available to any UK resident to help calculate the cost of a funeral where they live, as the report reveals prices can vary by thousands of pounds nationwide.

The cost of life’s moments

About One Family

OneFamily combines nearly 40 years’ experience of being the trusted provider of financial solutions for families and has more than £7bn of assets under management. OneFamily serves around one in 12 families in the UK. As a mutual, it is a member-owned business, investing in delivering value to its clients, rather than focusing on paying a dividend to shareholders.

OneFamily was formed by the merger of Family Investments and Engage Mutual in June 2015. OneFamily was named Best Junior ISA provider at the 2015 Investment Life and Pensions Moneyfacts Awards.

For more information, visit One Family